The AI-Ready Cable Landing Station is Coming

NJFX today announced the completion of a comprehensive Basis of Design for a new 10MW high-density AI data hall, delivering an expected 1.25 PUE and 8MW of usable IT load.

Ryan Imkemeier Explains the Importance of Equipment Maintenance, Vendor Relationships, Electrical Distribution & Managing the Team

CEO

July 22, 2022

OCTOBER 5 2017, WALL NJ – It is strong enough to withstand a Category 5 hurricane. It has redundant electric systems. And it connects directly to underseas fiber-optic cables from its campus to Europe and South America.

Is it enough to attract companies needing secure places to store their data?

“We shouldn’t be backyard to New York City all the time,” said Gil Santaliz, chief executive officer of New Jersey Fiber Exchange. “Why do we have to go to New York? We’ve got our own assets here.”

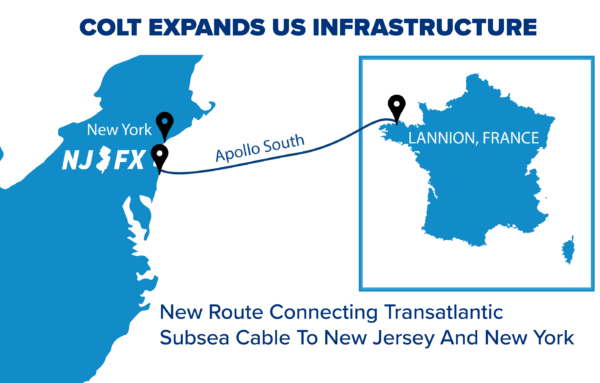

A year after it opened, New Jersey Fiber Exchange is trying to capitalize on one of the township’s hidden treasures: the landing point for three underseas fiber optic cables connecting the U.S. to Europe and South America.

For now, New Jersey Fiber Exchange, a 64,000-square-foot, two-story fortress, rents space to communication companies, which then deliver data from the facility to their customers.

But Santaliz and investors have bought another nearly 50 acres next door, betting that their system can be a draw to new data centers, giant buildings filled with servers that store reams of information on the internet.

“For a user who needs international connectivity, it could be very beneficial,” said Jonathan Meisel, a senior vice president at commercial real estate business CBRE, based in central New Jersey.

Santaliz, 51, of Spring Lake, decided the venture was worth leaving what was an early retirement.

He previously started 4Connections, a company that built fiber-optic connections that were used by New Jersey government agencies and hospitals, and he sold it in 2008 to Cablevision for an undisclosed amount.

He said he often wondered how to better connect his customers with the international market, and he turned his attention to Wall, a town with a rich communications history.

It was home, for example, to Guglielmo Marconi’s Belmar Trans-Atlantic Wireless station that played a key role in overseas communications in World War I.

And it was home to TyCom, which opened a center in 2001 to operate underseas fiber-optic cables. TyCom’s parent company, Tyco, sold the division to the India-based Tata Group in 2004.

Once the data arrived through the underseas cables to Wall it was routed to Manhattan, where communication companies set up shop in what’s called a “meet-me-room” to exchange data.

Santaliz’s idea: What if communication companies could meet in Wall instead?

He and a group of investors, including Tata, bought about 1.4 acres in 2015 next door to Tata’s operations center for $400,000, according to property records. He declined to disclose how much it cost to build the structure.

A year after it opened, New Jersey Fiber Exchange hosts 10 communications companies, from Tata to TI Sparkle, an Italian carrier. It offers faster speed for data. And it gives them another option in case other communication centers are hit by natural disasters, for example.

“We allow carriers to pick their routes and have less points of failure,” Santaliz said.

The project could pay off for Wall. Santaliz and his partners purchased another 48 acres nearby that could attract data centers — buildings that store companies’ data.

The industry is growing fast, keeping up with an explosion in data use. Investors have pumped more than $45 billion into the sector the past five years with more than half of that coming since the start of 2016, according to CBRE.

New Jersey has its share, primarily thanks to financial services companies in Manhattan that could store data more securely and less expensively across the Hudson River.

That segment of the real estate market in New Jersey peaked in 2012. And other parts of the country, namely northern Virginia, have surpassed partially because of lower electric costs, CBRE’s Meisel said.

But New Jersey Fiber Exchange with its access to the international market could give it a chance to compete, Meisel said.

“We live in a global world and a lot of these data centers connect with each other around the country and now around the world,” he said.

Wall officials said they welcome the industry. It will do little to create permanent jobs; just 10 people work full-time at New Jersey Fiber Exchange. But it would turn the dusty Clayton Block Co. property into a high-tech center — without much traffic.

“We’re trying to get that property back to a use that is less impactful to residents that live around there,” Wall Mayor Nick DiRocco said.

It would be a stretch to think Wall could compete with places like Loudoun County, Virginia, which boasts of being the traffic cop for 70 percent of the world’s internet traffic.

But Santaliz thinks Wall, with its rich history and prime location, could join Jersey City as another hub.

“By having the infrastructure where all this connectivity can exist, we should take advantage of it,” he said, “and that’s what we’ve done.”

See the original article by Michael Diamond – Asbury Park Press

###

About NJFX:

NJFX is a Tier 3 Carrier Neutral Cable Landing Station campus. Our colocation ecosystem has expanded to over 35 network operators offering flexibility, reliability, and security. Our Wall, NJ location provides direct access to multiple subsea cable systems giving our carriers diverse connectivity solutions and offers direct interconnection without recurring cross-connect fees.

NJFX today announced the completion of a comprehensive Basis of Design for a new 10MW high-density AI data hall, delivering an expected 1.25 PUE and 8MW of usable IT load.

NJFX today announced the completion of a comprehensive Basis of Design for a new 10MW high-density AI data hall, delivering an expected 1.25 PUE and 8MW of usable IT load.

Red Sea conflict threatens Key Internet Cables. Maritime attacks complicate repairs on underwater cables that carry the world’s web traffic.

Red Sea conflict threatens Key Internet Cables. Maritime attacks complicate repairs on underwater cables that carry the world’s web traffic.

Red Sea conflict threatens Key Internet Cables. Maritime attacks complicate repairs on underwater cables that carry the world’s web traffic.

Red Sea conflict threatens Key Internet Cables. Maritime attacks complicate repairs on underwater cables that carry the world’s web traffic.