The AI-Ready Cable Landing Station is Coming

NJFX today announced the completion of a comprehensive Basis of Design for a new 10MW high-density AI data hall, delivering an expected 1.25 PUE and 8MW of usable IT load.

February 9, 2016

Creating data centers at the edge of the network would seem to play well into the desire of legacy telecom operators to repurpose their traditional Central Offices as newer sites able to support virtualization, cloud services and more. But while there is momentum building behind one approach to doing this — developed by ON.lab — the general trend still has many skeptics, who point to environmental and cost issues involved in the transformation process, as well as the readiness of off-the-shelf hardware to perform in this environment.

“Converting COs to data centers is a topic that is coming up more often,” comments Heavy Reading Senior Analyst Rosalyn Roseboro, “but it’s also not all that clear-cut. There is still a lot of work to do around this.”

The most straightforward approach is the Central Office Re-architected as Data Center (CORD) project developed by ON.Lab through its ONOS Project. Both AT&T Inc. (NYSE: T) and Verizon Communications Inc. (NYSE: VZ) have signed on to ONOS, the latter citing CORD as the major reason, and AT&T is putting CORD to the test for delivering broadband services beginning in March. In addition, Ciena Corp. (NYSE: CIEN) has stepped up to offer a “hardened” approach to doing this. (See Verizon Looks to ONOS for Faster Transformation, ONOS Leaps over Initial Goals & Rapidly Expands Its Ecosystem, Ciena Offers Hardened ONOS for Next-Gen Central Office Conversions and AT&T to Show Off Next-Gen Central Office.)

There are also clear drivers in the virtualization effort for functions that don’t need to be on the customer premises, but would benefit from closer access than if they were only in the cloud.

Critics of any effort to repurpose COs on a grand scale point to significant challenges, including the need to continue to support regulated voice service and environmental issues such as space, power and cooling as well. These will complicate any effort to do mass conversion of legacy COs, Roseboro notes, and may produce a more scattered effort, with decisions made on a company-by-company or even a location-by-location basis.

The environmental costs, including bringing in AC power and equipping the space for the server racks that data centers require, have some folks questioning how widespread the CO conversion trend might be.

Checked it outGil Santaliz, founder and managing member of New Jersey Fiber Exchange (NJFX) , which is building a carrier-neutral data center in partnership with Tata Communications near its global cable landing site, said last month in a Metro Connect panel that his company looked at redoing COs that were available in the state as data centers but concluded it was much too expensive. (See NJFX Offers Fiber Hookup to Subsea Cables.)

“These are buildings that have been around for a long time, with batteries coming and going, and major load-bearing walls that would need to be taken down,” he commented. “When you factored in the cost of bringing in new power, and the size of the sites, it was lots of capex for a little bit of space.”

Read More: www.lightreading.com/…

— Carol Wilson, Editor-at-Large, Light Reading

###

About NJFX:

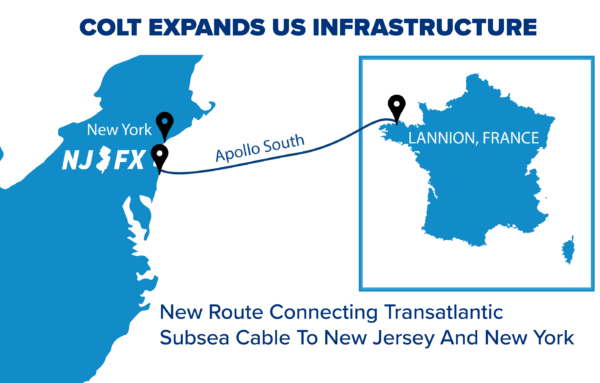

NJFX is a Tier 3 Carrier Neutral Cable Landing Station campus. Our colocation ecosystem has expanded to over 35 network operators offering flexibility, reliability, and security. Our Wall, NJ location provides direct access to multiple subsea cable systems giving our carriers diverse connectivity solutions and offers direct interconnection without recurring cross-connect fees.

NJFX today announced the completion of a comprehensive Basis of Design for a new 10MW high-density AI data hall, delivering an expected 1.25 PUE and 8MW of usable IT load.

NJFX today announced the completion of a comprehensive Basis of Design for a new 10MW high-density AI data hall, delivering an expected 1.25 PUE and 8MW of usable IT load.

Red Sea conflict threatens Key Internet Cables. Maritime attacks complicate repairs on underwater cables that carry the world’s web traffic.

Red Sea conflict threatens Key Internet Cables. Maritime attacks complicate repairs on underwater cables that carry the world’s web traffic.

Red Sea conflict threatens Key Internet Cables. Maritime attacks complicate repairs on underwater cables that carry the world’s web traffic.

Red Sea conflict threatens Key Internet Cables. Maritime attacks complicate repairs on underwater cables that carry the world’s web traffic.