This week, Industry Outlook talks with Gil Santaliz, founder and CEO of NJFX, about how data center companies can differentiate themselves in a changing landscape. Previously, Gil was CEO, founder and managing member of 4Connections LLC, a 500-mile New Jersey fiber network serving many verticals in that state. 4Connections pioneered the deployment of carrier-neutral dark-fiber services for both New Jersey and New York City. In 2008, he successfully exited the business in a preemptive transaction with Optimum Lightpath, a wholly owned subsidiary of Cablevision. Having over two decades in the communications industry, Gil’s reemergence in telecommunications demonstrates his ability to anticipate market drivers and solve complex connectivity challenges both domestic and internationally.

Industry Outlook: Are all data centers essentially built the same, with all providers using the best technologies, or can a company build a facility with some sort of “secret sauce”?

Gil Santaliz: I can definitely say that all data centers are not the same. Each one brings something different to the table. Sure, we all have standards, but in today’s market, you don’t see many shared or proprietary data centers being built because so many are already out there. They must be able to differentiate themselves from the rest of the pack, and they do so through their geography, specialty ecosystems and ability to serve customers’ immediate needs. Just because a data center has a particularly robust set of carriers doesn’t mean it meets the reliability and security standards needed to keep your data safe. In the end it’s a compromise, because it’s tough to get a highly reliable, highly secure and highly connected site, but that’s the magic combination you are constantly striving towards.

IO: Can site selection alone serve as a differentiator?

GS: Site selection is always a differentiator. Geography is the most important factor for accessing and transporting your data efficiently. Don’t be fooled though, because the network ultimately determines the location of a great data center. The days of opening a facility anywhere are over. The network potential must be there first.

IO: Do you see ecosystems developing away from the traditional hubs—e.g., New York City and Ashburn?

GS: Ashburn is here to stay, but New York City is a relic. Whether people want to believe it or not, data center computing left New York City years ago, and what’s left is the legacy carrier infrastructure. Don’t get me wrong, there are things that should be there, but Manhattan alone shouldn’t support Connecticut, New Jersey, Ashburn and the like. The network design for New York City data centers was built 30 or 40 years ago, but for some reason it continues to be the hub for international traffic. When the time comes, moving that legacy infrastructure will be difficult, but the next step should be the transition of the infrastructure that doesn’t need to be there.

IO: What can data center providers do to simultaneously serve local and global customers?

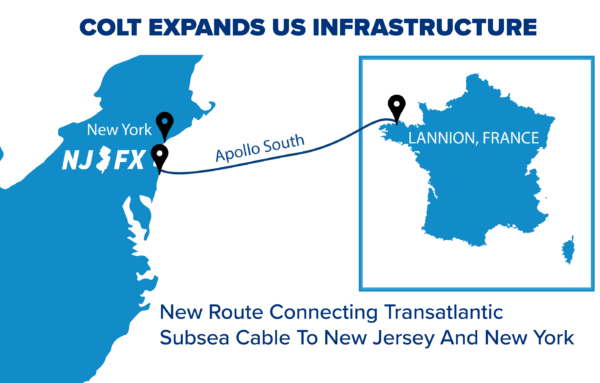

GS: Combine your subsea networks with U.S. networks to create that hyper-attractive market of international and “locally global.” If you aren’t fortunate enough to have a subsea network in your facility, you need to get access to multiple systems. The idea of connecting subsea networks with the U.S. creates a unique opportunity to ensure a highly connected, globally local presence. This strategy will mean fewer points of presence and more options for point-to-point connections between locations.

IO: What is driving the changing data center landscape?

GS: I believe consolidation is critical, and it’s always driven by efficiencies across the market, not to mention the economy to scale. Customers want fewer relationships with the providers that have more assets, and we are finding that it supports this consolidation trend.

IO: How can data center providers successfully deviate from traditional offerings to meet customer demands in this landscape?

GS: The pendulum swings when it comes to cloud solutions versus proprietary data center solutions. We’re seeing customers looking for flexibility with the option of prioritizing which applications should be in the cloud and aren’t necessarily data center specific. Providers who have that flexibility can tailor their product to best serve their various customers. As I mentioned before, I believe the main driver for the changing data center landscape is consolidation along with ecosystems in the marketplace—a portal where buyers and sellers can collaborate to create solutions.

IO: Can you expand on the idea of consolidation as a major driver of change?

GS: Today, more and more data centers are seeing that the customer wants options: multiple locations with several service offerings, all within the same set of standards. This situation is forcing smaller players to work—if not merge—with larger ones. I don’t see this trend stopping anytime soon. Also is the capacity to scale that comes from multiple locations with central cabinets, billing and systems. The market has a lot of synergy. The only way to survive as an independent operator is to have something truly unique to offer.

IO: Which model is better—offering managed and cloud services on your own, or referring to third-party providers?

GS: At NJFX, we believe a third-party provider eliminates conflicts between the tenants and the landlord. No one wants to compete with their customers, and by having a model where you don’t need to, operators can enable innovation and spur opportunities for providers to come in and offer unique services. That arrangement is quite honestly the best of breed. That’s what makes NJFX special—we meet data center standards with optimal carrier-hotel connectivity.