Editor’s Note: I recently had the opportunity to interview Gil Santaliz, CEO of NJFX. Gil is one of the new breed of professionals that is taking the submarine fiber optic cable industry in a different direction to meet the needs of a changing landscape; in NJFX’s case by bringing together submarine cables, cable stations, data centers and terrestrial fiber networks in an open environment. The following are Gil’s comments on how the industry has changed and where it is headed in the future.

There are a couple of things that are happening right now. First, the cables that were put in play around the year 2000 had a 20-year life. When they were built, many used the consortium model. So the providers that jumped into those systems had a lot of capex and a commitment to run those cables for a specific period of time. What’s happened is that those cables have now gotten to a point in their lifespan where the O&M exceeds the true cost of the cables – in terms of what they can charge for capacity on those cables.

I was speaking to members of one consortium whose cable was built at the turn of the century and the costs for keeping that cable working are twice what it would cost to buy the same amount of capacity on the new Aqua Comms cable (HAVFRUE).

Then you have these new players, the OTTs (over-the-top content providers), who are saying, “I can’t allow the telecom industry to hold me hostage under rules that limit my ability to scale. I’m going to lead the way. I’m going to get in front of the economics and I’m going to drive these new projects.” And that’s how you see Facebook, Google, Microsoft and others playing active roles in these new cables with a handful of selected carriers. Not everyone gets to play, only a few get to play this time.

Going forward you will find certain carriers will have economics that are much different than the rest of the pack. Those that have the right economics are going to be the leading carriers when it comes to those cables going forward; the rest are going to have to buy from those that have the access to those cables.

And because the cables now have capacity that is so much greater, we might see less deployment in Round 2 than the first time through, which means you’re going to have a bunch of carriers really lagging if they are not part of the projects.

There are a couple of important dynamics in the industry. This industry started with companies having monopolies. That’s the genesis of telecommunications – we began with the PTTs (Posts, Telecommunications and Telegraph) for countries that were basically given a monopoly for the territory. Everything evolved from that environment to an environment of deregulation where you had open competition, but inevitably, those that had the most assets still won. So as the system still benefitted the larger players, it was hard for the small guys to come in and compete. Now you have new kids on the block who don’t want to be held hostage with their application because some still have ingrained the monopolistic views and create price protection by, for example, picking systems that only a few providers have and have pricing set by one incumbent for the backhaul for them.

They’re saying “no, no, no!” This is an open marketplace with economics not only for the carriers but also for the guys who make the Internet work, and that’s the OTTs. So what we’re seeing is this revolution continue with new players coming in and pushing hard on the old guard and saying, “If you don’t play with me, you’re not in the game because I’m going to front these new projects and I’m going to pick the best operators to work with. Those that I know are reliable, that are willing to be open with me and we’re going to change the landscape of how these cables interconnect continents.”

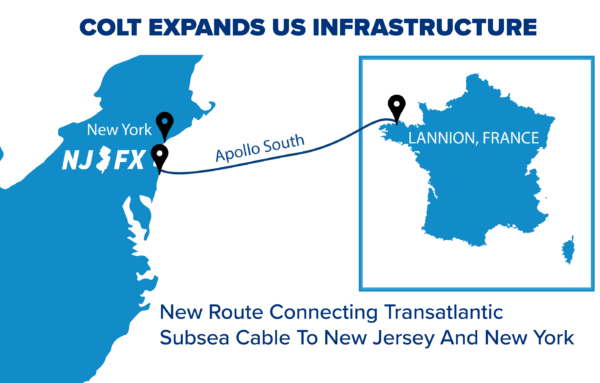

One of the things that NJFX is proud of is to be a part of this new open architecture. Our cable landing station campus is not owned by a carrier. We don’t care how these guys interact in an open marketplace. This allows for a monopolistic view to go away. We allow competitive carriers to figure out price discovery on their own. We allow best of breed providers to interact with those on the submarine network and applications will flourish.

So the difference is an open marketplace. You have a new guard now, and the old guard is trying to figure out what it’s going to become because when you have a monopolistic business, you’re allowing for a lot of inefficiencies that are now being streamlined out of the process.

This is a changing environment, it’s a revolution we’re seeing in front of our eyes. The subsea telecom world changing. The landing points changing. And it’s more predictable than you think. If you sit down with Telegeography and look at all the cables that have been deployed in the past 20 years, you might want to guess the next cable announcement coming out.