Bloomberg TV: Undersea Cables at NJFX

Red Sea conflict threatens Key Internet Cables. Maritime attacks complicate repairs on underwater cables that carry the world’s web traffic.

April 22, 2019

Capitalism has risen again as the dirtiest word in the American political landscape. A lot has been made about the moral aspects of competitive free markets. Those who see capitalism as immoral say greed makes companies put profits over people. Others say capitalism is the only system that has the power to pull people out of poverty. While the idea of the greedy CEO is not a new one, it’s gaining even more traction as Americans begin to question the cost vs. benefit of a free market economy.

To combat the appearance of the greedy corporation, businesses have put corporate responsibility in place – a system to donate funds to worthwhile causes. While that may seem to solve the issue, it’s sort of the easy way out. There must be a way to move beyond implementing a local community program or creating a company foundation. That level of corporate responsibility is not difficult to achieve but may not go far enough to relieve the perception that corporations only care about making as much profit as possible, despite the consequences.

There is a difference between corporate responsibility and conscious capitalism. The latter refers to a self-examination and self-awareness that asks, can we be mindful of our stakeholders and the public at the same time? This type of socially responsible capitalism means that we are looking out for everyone’s interests, while also running a profitable business. In this scenario customers, vendors, investors and employees all win. Too many companies use profitability as their underlying mission as opposed to creating balance and harmony between customers, vendors and investors. This harmony is the only way to stay in the game long term. Putting open door policies in place, where there is a willingness to listen to all parties, makes you what you are.

After selling highly successful 4Connections to Cablevision (now Altice) and settling into a comfortable retirement, NJFX founder Gil Santaliz served two terms on the Board of Morristown Memorial Hospital Foundation. He served as a Trustee for the Morristown-Beard School. But Santaliz felt there was more to do.

When the idea for NJFX was first imagined, it was an effort to find an infrastructure solution for New Jersey. The number one goal was not “How much can NJFX profit from existing?” Santaliz spearheaded the effort to invest millions of dollars to develop a world class facility at the highest elevation possible to ensure North America would have network diversity. Part of this effort included committing to a carrier-neutral model to avoid monopolistic behavior which has traditionally been the norm with cable landing stations globally. This disruptive approach supports socially responsible capitalism by protecting carriers, enterprises and OTTs from landlords that don’t always have their tenants’ best interest in mind.

This was possible in part because NJFX partners already had their own successful, independent businesses before coming on board at NJFX. The opportunity to help the state of New Jersey and surrounding regions with connectivity was the overarching factor for those investors who chose to help finance the project. This investment was a solution to aging and lacking infrastructure for both New Jersey and the U.S. The investors recognized this gap and wanted to play a role in creating better, more viable telecommunications infrastructure. The investors live in the communities that they operate the businesses in. They are cognizant of both helping the community and being a productive member of the community.

The biggest concern is that the industry is under intense pressure for profitability. Some carriers face Wall Street pressure. If they don’t perform, the idea of socially responsible capitalism can go off the rails. But we need to be mindful as a nation to not let profit get in the way of long-term results. Unfortunately, there are companies that given the opportunity will price gouge in the telecom industry. They charge exorbitant prices because they can. We’ve witnessed it and frowned upon it. A company might charge a customer for a line in a contract that went unnoticed or change that was needed. We’ve seen it happen globally, but also here in the U.S.

While NJFX relies on developing a profitable business, it has not taken on any outside debt and made the decision to be here long-term and provide infrastructure in a sustainable way. NJFX recently hosted multinational banks for a summit. The bank leadership teams were appreciative of the effort because their financial customers are selling trust – and they cannot provide their service without having credible partners in place who take instilling trust seriously and deliver upon it. Financial institutions count on reliable partners who have fairness and equity as part of their core tenets.

This idea of profit plus conscience goes both ways. When we work with our contractors, we’ve kept a record of 99% satisfaction in those relationships. Construction is never an easy process and we balance getting a product we think we deserve and paying the contractor fairly. With our customers and partners, we provide opportunities for introductions to grow their business by leveraging our global relationships. We have transparency in how we operate and how our industry works. And finally, with our employees, we’ve created programs to allow them to grow personally. We intentionally put them in positions of exposure to foster growth.

In today’s market if you don’t provide balance between profit and the responsibility to vendors, employees and customers, it’s very difficult to grow your business long term. The idea of sustainability lies in one word: fairness. You can make money, and still be equitable and just in your business relationships and economic models.

About Gil Santaliz

NJFX CEO, Gil Santaliz, is a well-respected thought leader in the subsea industry. He recently earned a spot on Capacity Media’s coveted Power 100 list. His innovative approach to thinking outside traditional telecom ways of partnerships and network architecture, has led him to establish a unique offering that impacts global communications. As founder of a metro fiber network company called 4Connections LLC, Gil realized there was a lack of route diversity for carriers. New York was the hotspot for internet landing points. A single point of connection means a single point of failure, and Gil knew this was something that needed to be solved. Gil sold 4Connections to Cablevision, now owned by Altice. Santaliz’s knowledge of internet infrastructure and its limitations, led to NJFX. This year Santaliz was invited to join the Submarine Networks EMEA 2020 Advisory Board as well as the Pacific Telecommunications Council (PTC) Advisory Board. Santaliz graduated from Cornell University in 1988, with a Bachelor of Science.

###

About NJFX:

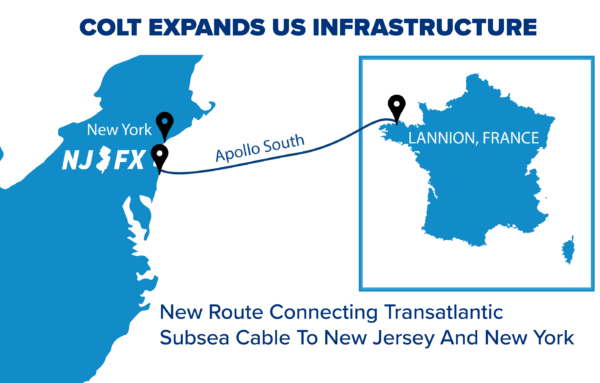

NJFX is a Tier 3 Carrier Neutral Cable Landing Station campus. Our colocation ecosystem has expanded to over 35 network operators offering flexibility, reliability, and security. Our Wall, NJ location provides direct access to multiple subsea cable systems giving our carriers diverse connectivity solutions and offers direct interconnection without recurring cross-connect fees.

Red Sea conflict threatens Key Internet Cables. Maritime attacks complicate repairs on underwater cables that carry the world’s web traffic.

Red Sea conflict threatens Key Internet Cables. Maritime attacks complicate repairs on underwater cables that carry the world’s web traffic.

Red Sea conflict threatens Key Internet Cables. Maritime attacks complicate repairs on underwater cables that carry the world’s web traffic.

Red Sea conflict threatens Key Internet Cables. Maritime attacks complicate repairs on underwater cables that carry the world’s web traffic.

Red Sea conflict threatens Key Internet Cables. Maritime attacks complicate repairs on underwater cables that carry the world’s web traffic.

Red Sea conflict threatens Key Internet Cables. Maritime attacks complicate repairs on underwater cables that carry the world’s web traffic.

Experience the flexibility, reliability, and security yourself