From service vehicle routing and data science to voice assistants and network planning, artificial intelligence is becoming a staple in the telecoms industry. Recently, NVIDIA surveyed 400+ telecom industry professionals around the world on their views about the opportunities and challenges of implementing AI-driven practices across their company and in the industry. This report summarizes the key survey insights, as well as the investment decisions and

implementation approaches that define the state of AI in telecoms in 2023. While the responses show that there’s significant interest in AI, it’s also clear that the industry is in the early stages of its AI adoption journey and needs support to clearly define ROI.

The Key Trends for Telecommunications in 2023

The telecoms industry delivers critical infrastructure and services across enterprise and consumer industries, providing efficient connectivity for communication and online services around the world. Telcos (whether fixed, mobile, or cable providers) are the key players in this industry.

Together with other industry stakeholders, they spend billions of dollars annually to drive technological innovation, create new products and services, modernize their infrastructure, improve operational excellence, and deliver profitability to their shareholders. AI is increasingly an integral part of the investment roadmap, as telcos look to achieve their goals in an energy-efficient and environmentally friendly way.

In the 5G era particularly, AI will support telcos as they seek ways to deliver on expectations that 5G will bring revolutionary change across industries, while gaining a return on the significant investments they’ve made in capital, spectrum, deployment, and maintenance.

The telecoms industry is broadly positive on the need for AI in telecoms. The International Telecommunications Union (ITU)—the UN’s specialized information and communication technology (ICT) agency—promotes the AI for Good initiative. Likewise, the AI for Impact initiative by GSMA brings together a task force of 24 mobile telcos and an advisory panel of 12 UN agencies and partners to promote use of AI to achieve the UN’s Sustainable Development Goals (SDGs).

Perspectives From the Field

Beyond the grand industry visions and activities, this report focuses on the views of telecom industry professionals who are tasked with implementing and delivering AI in the field. It sets out to explore how committed the telecoms industry is to driving adoption of AI and how much impact AI is already having on those who have deployed it.

The report captures key insights from the survey, conducted November 2022– January 2023, which asked 400+ respondents to quantify the opportunities and challenges of adopting AI across their business. It includes insights on how the industry is approaching AI and the role of partners in implementing AI solutions in the telecoms industry.

Survey respondents represented a mix of telcos (including mobile, fixed, and cable companies) and their hardware and software suppliers. The respondents were a good mix of different groups, like customer service, marketing, and business development, and the results include feedback from manager-level industry professionals, including senior executives.

There’s Clear Interest in and Expectations of Success From AI

In line with the industry-level expectation on the importance of AI in telecoms, the survey

shows that there’s a clear interest in AI among industry stakeholders. Of overall respondents, 95 percent said they were engaged with AI, with the figure rising to 100 percent among decision-making management respondents.

shows that there’s a clear interest in AI among industry stakeholders. Of overall respondents, 95 percent said they were engaged with AI, with the figure rising to 100 percent among decision-making management respondents.

Telcos have announced they’ve tested AI-enabled solutions for network operations, base station site planning, truck-routing optimization, and machine learning data analytics. To improve the customer experience, some are adopting recommendation engines, virtual assistants, and digital avatars. For many respondents in the survey, however, the engagement was described as at an early stage.

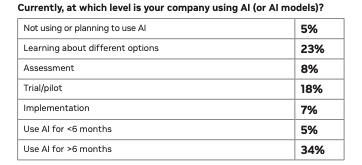

Only 34 percent of respondents reported using AI for over six months, while 23 percent of respondents said they’re still learning about the different options for AI. Eighteen percent reported being in a trial or pilot phase of an AI project.

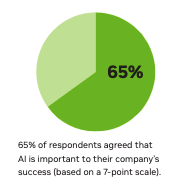

This level of engagement feeds into the expectation that AI will deliver competitive advantage and success. In the survey, based on a 7-point scale, 59 percent of respondents agreed with the statement “AI will be a source of competitive advantage for my company,” while 65 percent of respondents agreed that AI is important to their company’s success. But not everyone agrees with the industry-level view on the importance of AI in telecoms. On the same 7-point-scale question, about 12 percent of respondents disagreed that AI has a role in their company’s success.

Operational Optimization Is the Biggest Opportunity

Managing operations in the telecoms industry is a very complex task.This is understandable, as the industry is responsible for critical national infrastructure in every country, supports over 5 billion customer end points, and is expected to constantly deliver above 99 percent reliability. Each network interface or customer touch point is potentially a drag on efficiency, creating a constant need for industry stakeholders to invest in solutions that improve operational efficiency.

reliability. Each network interface or customer touch point is potentially a drag on efficiency, creating a constant need for industry stakeholders to invest in solutions that improve operational efficiency.

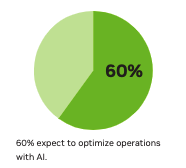

For an industry whose top priority is to build and operate the best network, AI-enabled practices and services, perhaps not surprisingly, were seen as the low-hanging fruit. Some 60 percent of respondents said AI automation that replaces or augments human effort will drive gains in efficiency. The next two expectations are also related to efficiency: 44 percent of respondents expect AI to reduce cost of operations, and 35 percent expect AI to enhance customer engagement.

Early Results Show Positive Impact of AI on Revenue and Cost

For respondents at the trial or implementation stage, a clear majority acknowledged that there had been a positive impact on both revenue and cost. About 73 percent of respondents reported that implementation of AI had led to increased revenue in the last year, with 17 percent of respondents noting revenue gains of more than 10 percent in specific parts of their businesses.

Likewise, 80 percent of respondents reported that their implementation of AI led to reduced annual costs in the last year, with 15 percent of respondents noting that this cost reduction is above 10 percent—again, in specific parts of their business.

Inability to Quantify ROI Is the Biggest Challenge

There are a myriad of challenges facing the adoption of AI in the telecoms industry. Despite reports of the positive impact of AI on revenue and cost, many respondents still struggle to quantify the ROI of their AI investments. Some 44 percent of respondents cited an inability to adequately quantify ROI, which illustrates a mismatch between aspirations and the reality in

introducing AI-driven solutions.

Technical challenges—whether from lack of enough skilled personnel or poor infrastructure—are also obstructing AI adoption. Of respondents, 34 percent cited an insufficient number of data scientists as the second-biggest challenge. Given that data scientists are sought after across industries, the response suggests that the telecoms industry needs to push harder to woo them.

With 33 percent of respondents also citing a lack of budget for AI projects, the results suggest that AI advocates need to work harder with decision-makers to develop a convincing case for AI adoption. Likewise, for a technology solution that relies on data, concerns about the availability, handling of, privacy, and security of data were all critical issues to be addressed, especially in the light of data privacy and data residency laws around the globe (e.g. GDPR).

Investment Levels in AI Are Still Low Compared to Industry Capex

In an industry with a multi-billion capex spend per annum, the level of investment in AI appears to be low. Typically, mid- to large-size telcos will spend at least a billion dollars annually on capex. Yet, 60 percent of respondents (for 2021) and 50 percent of respondents (for 2022) spent less

than $1 million on AI. On the top end, 2 percent of respondents spent over $50 million in 2021, rising to 3 percent in 2022.

While the responses can partly be attributed to where the respondents are in AI

adoption, it suggests that the industry’s level of investment in AI is not matching

its level of enthusiasm and engagement. Indeed, 33 percent of respondents noted

a lack of budget, and only 42 percent of respondents agreed that their current

investment is at the right level. Going forward into 2023, 47 percent of respondents reported plans to increase their AI investment, while 45 percent said they’ll be keeping it broadly the same.

Only 8 percent of respondents said they’ll be decreasing their AI spend.

Scaling Beyond Proof of Concept and Pilots Is a Major Driver for AI Investments

Among all the factors driving investments in AI, moving from proof of concept and pilot stage to implementation was the most notable response. This isn’t always an easy step to make; only 30 percent of respondents agreed that their companies have the capability and knowledge to move an AI project from research to production.

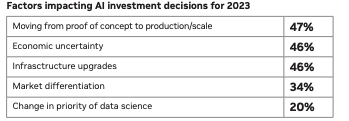

While a total of 49 percent of respondents said they were still in the learning, assessment, or trial/pilot phase of their AI investments, 47 percent of respondents said implementation plans will drive their investment decisions. Economic uncertainty and the need to prioritize spending elsewhere also drove decision-making. Some 46 percent of respondents cited concerns about

the economy; similarly, 46 percent of respondents said AI investments will be balanced against spending on scheduled infrastructure upgrades. And 34 percent of respondents noted that their market differentiation strategies are a major factor in their AI investment decisions.

Improving Network Operations and Optimizing Customer Experiences Attract the Most AI Investment

Consistent with the expectations to use AI to optimize operations, respondents noted that their companies are prioritizing AI investments in network operations, customer experience optimization, and network planning today. AI algorithms are leveraging terabytes of network data from telcos to detect anomalies, predict failures, streamline operations, and enhance security and fraud detection in the network. For customers, as the responses show, telcos are using AI to improve engagement through solutions like virtual assistants, enrich the retail experience,

provide recommendations, and manage churn. In the next 6–12 months, respondents plan to increase investment in predictive maintenance as telcos seek to leverage AI to proactively identify and fix problems in their hardware and software infrastructure. This includes

customer on-premises equipment such as mobile devices and set-top boxes.

Of respondents, 61 percent named machine learning and 54 percent named its accompanying high-performance computing platform as their AI tools of choice, which reflects the maturity of those technologies for use across industries. However, the quest to unearth insights from telco data is also driving investment in deep learning, according to 42 percent of respondents. Similarly, 27 percent indicated an interest in digital twins and simulation, where they can test things like infrastructure upgrades in the virtual world before rolling them out in the real world.

AI Is Deployed Mostly in Hybrid (Cloud and On-Premises) Environments

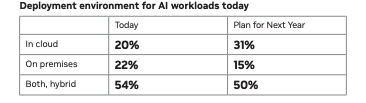

When it comes to infrastructure, 54 percent of telecom companies are deploying AI solutions in hybrid environments, as they seek to enjoy the efficiencies of the cloud while holding on to the enhanced isolation and control of the on-premises environment. For those who are either using hybrid or cloud environments, 58 percent of respondents are happy with their choice, while 55 percent of those using hybrid or on-premises environments are happy. But a move toward an all-cloud environment is evident. Fifty percent of respondents plan to go or stay hybrid in the next year, and 31 percent want to focus exclusively on the cloud. Only 15 percent plan to stay solely on premises.

Choice of Environment Is a Trade-Off Between Security and Performance

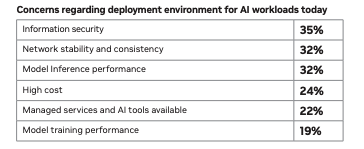

The biggest areas of concern regarding the deployment environment weren’t surprising:, 35 percent cited information security, 32 percent cited network stability and consistency, and 32 percent cited model inference performance. These correlate to responses about the choice of cloud, on-premises, or hybrid deployment. Those who are worried about information security were more likely to choose an on-premises environment. Conversely, those who seek to

benefit from the wide variety, availability, and performance of cloud solutions

were more likely to choose a cloud environment. The lower priority of cost in this decision is insightful, as it suggests more respondents consider a more strategic approach to AI rather than a tactical, cost-driven quest for the cheapest solution in the market.

Partnerships Are Critical for AI Solutions in the Industry

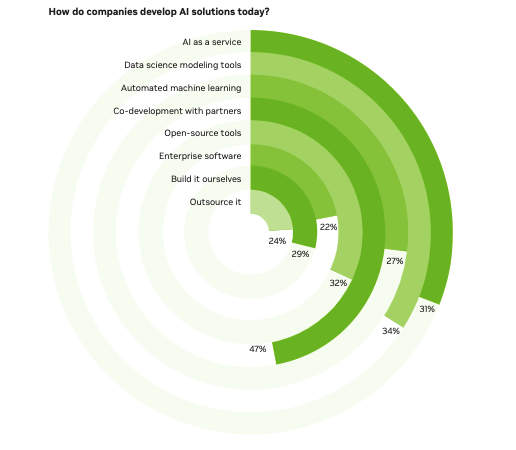

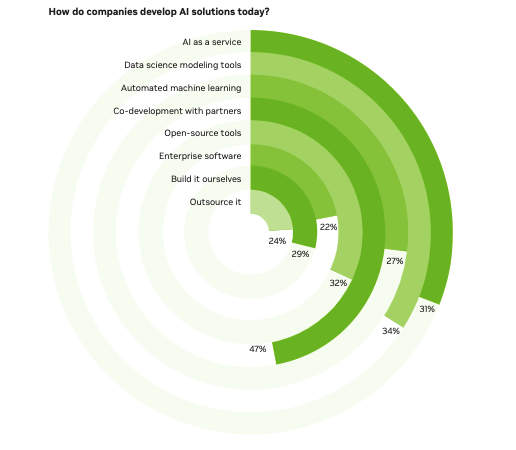

Telcos rely on their partners for supplies, support, and expertise to build infrastructure, run operations, or develop services for customers. This also applies to AI, especially given that 29 percent of respondents view their companies as AI laggards and only 18 percent are confident that they’re industry leading. It’s therefore not surprising that the need to engage partners featured regularly in the responses to the survey. Forty-seven percent of respondents reported

that their AI solutions are co-developed with partners, and 61 percent said their top priority when spending on AI was to “engage third-party partners to accelerate AI adoption.” Often, this need for partners is non-negotiable. A massive 83 percent of respondents said they would sometimes or always engage third-party consultants or software vendors to complete an AI project.

Partnerships also create opportunities for telcos to create new services for customers at lower investment and with the ability to scale fast. Fifty-one percent of respondents said they develop AI solutions for both internal and external users.

Looking Forward

The role of AI in telecoms is only just starting. AI will permeate all segments of the value chain, helping to drive transformation in network planning and deployment, network operations, customer engagement, and creation of new products and services. In doing so, AI will unlock opportunities and address challenges that can impact both the bottom line (through TCO improvement by optimizing capex and opex) and the top line (by generating new revenue).

Telecom leaders are already investing significantly in AI. However, the industry as a whole lags in AI investment compared to their overall capex spend. The encouraging news is that the majority of survey respondents signaled a desire to increase their AI investments and to push for better clarity on ROI in the next year. Ultimately, it’s expected that telcos and other industry stakeholders will embrace AI to improve operational efficiency and deliver better customer experiences. In the near term, the focus appears to be on building more effective telecom infrastructure and unlocking new revenue-generating opportunities, especially together with partners.

shows that there’s a clear interest in AI among industry stakeholders. Of overall respondents, 95 percent said they were engaged with AI, with the figure rising to 100 percent among decision-making management respondents.

shows that there’s a clear interest in AI among industry stakeholders. Of overall respondents, 95 percent said they were engaged with AI, with the figure rising to 100 percent among decision-making management respondents.

reliability. Each network interface or customer touch point is potentially a drag on efficiency, creating a constant need for industry stakeholders to invest in solutions that improve operational efficiency.

reliability. Each network interface or customer touch point is potentially a drag on efficiency, creating a constant need for industry stakeholders to invest in solutions that improve operational efficiency.