NJFX new connection routes via Sparkle’s Seabras-1

NJFX new connection routes via Sparkle’s Seabras-1

NJFX, also known as the New Jersey Fiber Exchange, has announced a new way for carriers to reach the United States via the TGN-A and Seabras-1 cable systems.

See the Original Article by Natalie Bannerman HERE

October 25, 2017

NJFX customers can use these strategic subsea cables via secure Network to Network Interfaces (NNI) at NJFX’s New Jersey colocation campus. In addition, the two new subsea cables also allow carriers, service providers, content companies and enterprises high capacity, while eliminating traditional points of failure when providing US to Europe, US to Brazil and US to Asia connectivity.

Gil Santaliz, NJFX founder and chief executive officer, said: “Our new breakout capability allows carriers to use these subsea systems to reach the U.S. and bypass traditional routes that have multiple hops. This is crucial not only to reduce latency, but also in terms of increasing reliability and disaster recovery options. You only have to look to recent hurricanes to see that for communications hubs, one disruption in the chain could mean disruption in financial transactions, communications and connectivity to South America.”

The TGN cables are submarine cable systems connecting Highbridge UK to Wall, New Jersey. Seabras-1 is a 10,500-km fiber optic cable that connects Sao Paulo, Brazil to the US. It offers connectivity to financial markets and other Latin America enterprises and bypasses the Atlantic hurricane zone.

Federico Porri, CTO at Sparkle Americas, added: “Customers at NJFX with the most stringent latency and diversification requirements, and who need higher reliability, can now enjoy direct advanced connectivity solutions to Brazil and beyond through Sparkle’s Seabras-1 capabilities. As we are constantly working to provide more value and secure diversity options for our customers, we are happy to partner with NJFX, a company that provides a very reliable and flexible environment with great backhaul partners.”

###

About NJFX:

NJFX is a Tier 3 Carrier Neutral Cable Landing Station campus. Our colocation ecosystem has expanded to over 35 network operators offering flexibility, reliability, and security. Our Wall, NJ location provides direct access to multiple subsea cable systems giving our carriers diverse connectivity solutions and offers direct interconnection without recurring cross-connect fees.

More In the News

Chile’s Digital Transformation

Chile’s Digital Transformation Gil Santaliz CEO Ryan Imkemeier Cable Landing Station Manager Originally published by Capacity Media on May 17, 2021. May 19, 2021 In March

Chile’s Digital Transformation

Chile’s Digital Transformation Leveraging its Pacific coast, Chile will soon host a digital gateway linking Latin America to Asia. But with the power to solve a

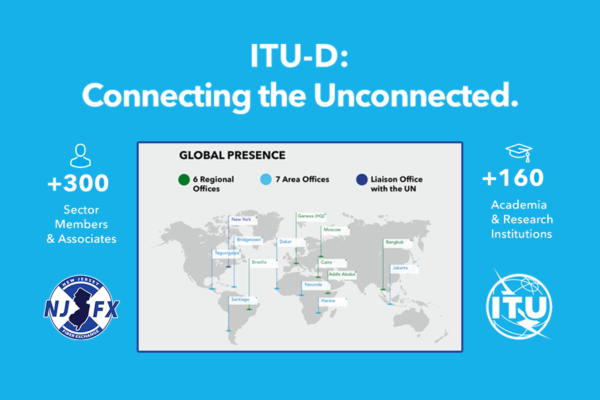

NJFX Participates with the United Nations in Helping to Bridge the Digital Divide

NJFX Participates with the United Nations in Helping to Bridge the Digital Divide Efforts Aimed at Getting the Other Half of the World Online March

Zayo Bolsters Fiber Network Capabilities at NJFX Cable Landing Station

Zayo Bolsters Fiber Network Capabilities at NJFX Cable Landing Station Enables Increased Capacity and Diversity and Offers Customers Access to Four Subsea Cables February 22,

Hurricane Electric Expands Global Network to New Jersey With New Point of Presence at NJFX

Hurricane Electric Expands Global Network to New Jersey With New Point of Presence at NJFX Located in the only Cable Landing Station Colocation Campus in

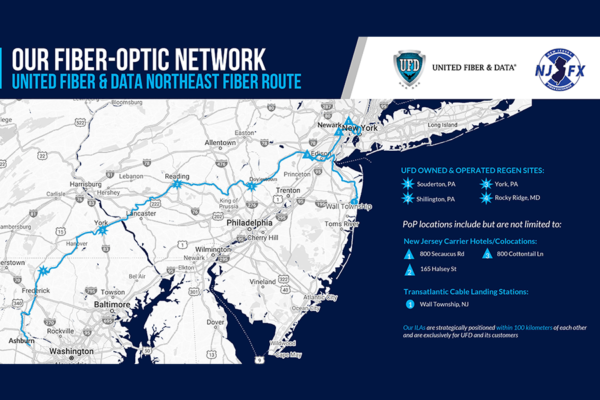

NJFX Boosts Its Interconnection Ecosystem with New and Diverse United Fiber & Data Fiber Route

NJFX Boosts Its Interconnection Ecosystem with New and Diverse United Fiber & Data Fiber Route November 18 , 2020 Wall Township, NJ – NJFX, the

NJFX new connection routes via Sparkle’s Seabras-1 Read More »