Luminaries in Telecom – Redefining the New Generation of Global Network Connectivity – John Hayduk

Luminaries in Telecom | John Hayduk

Redefining the New Generation of Global Network Connectivity

Written + Edited by:

Kevin Ayerdis + Emily Newman

February 5, 2024

Welcome back to Luminaries Of Telecom!

In the ever-evolving landscape of telecommunications, a realm continually reshaped by breakneck technological advancements, stands a luminary who has not just witnessed but actively sculpted our hyper-connected world. John Hayduk is a visionary in the realm of global network connectivity and has built a remarkable career path paralleling the industry’s transformation. Hayduk’s journey reflects a shift from the simpler, quieter days of analog to the dynamic, intricate webs of the modern digital era.

Pioneering the Digital Communication Revolution

John Hayduk’s distinguished career in telecommunications took root in the suburbs of Pittsburgh, Pennsylvania. After graduating from Penn State in 1990, he embarked on his professional journey in New Jersey at the infamous Bellcore that eventually morphed into Telcordia. This transformation marked a significant phase in his career. With his master’s degree in computer science and specializing in software development, Hayduk took on a critical role at Telcordia.

Hayduk explains, “At Telcordia, after dedicating four to five years to software development, I was presented with a pivotal career decision: to continue the technical track or to transition into management. Choosing the latter, I embarked on the managerial track. This shift involved overseeing software development teams, with each role bringing larger teams under my guidance and expanding responsibilities.”

Following several years of successfully managing various development teams, Hayduk was offered a new role managing a P&L focusing on a suite of applications dedicated to Wireless Network Management at Telcordia.

Reflecting on this period, Hayduk notes, “By 2000, cell phones had become a common accessory for most people. The period from 1996 to 2000 was crucial in the wireless business. At Telcordia, we were developing and providing software solutions for major wireless providers to efficiently operate their networks. This era marked a time of rapid expansion in wireless networks, aligning with the widespread adoption of mobile phones. Notably, the end of ‘03 saw revenues reaching $100 million, and by 2004-2005, we witnessed a surge to approximately $140-150 million.”

Architecting Global Connectivity

After a decade of shaping the telecom landscape at Telcordia, Hayduk was poised for a new challenge. In 2005, he made a strategic move to Tata Communications marking a pivotal point in both his career and the company’s trajectory. This era signified the dawn of Tata’s expansion into international services. With Hayduk’s extensive background in software and a proven track record of seamlessly blending technical expertise with strategic insight, Hayduk assumed the role of Chief Technology Officer.

Upon joining Tata Communications, Hayduk found himself at the heart of the company’s pivotal growth phase. He played a significant role during key milestones, notably the acquisition of Tyco Global Network (TGN). This strategic move endowed Tata with substantial subsea capabilities, extending from the Atlantic to the Pacific, and significantly enhancing their network with various Points of Presence (PoPs). Just 8-9 months following this, Tata further expanded its reach by acquiring Teleglobe, adding an additional 45-50 international PoPs to Tata’s network, and a significant global IP backbone.

Hayduk reflected on the evolving challenges in the industry, stating, “The landscape of technology was undergoing a drastic transformation. Around 2002-2003, we saw a shift with internet usage, voice calls transitioning to video collaboration, and the start of cloud based computing and storage options. This change had a profound impact, not just in terms of the nature of communication, but also in the bandwidth requirements. The rising demand for network capacity, coupled with the trend of cloud computing and the shift towards cloud-based processing, posed unique challenges to our network’s ability to meet those needs.”

He continues, “We could no longer afford delays in reconfiguring or upgrading our infrastructure to meet these demands. My background in software, particularly in supply chain management with our capacity vendors, became crucial. It enabled us to rapidly scale up our services, ensuring that when a major customer placed an order, we could meet their needs with exceptional speed.”

During his tenure at Tata Communications, Hayduk played a pivotal role in orchestrating complex initiatives and deploying a new subsea cable in the South China Sea. His responsibilities extended beyond technology, involving intricate supply chain management and international vendor relations, highlighting his adeptness in navigating the complexities of global telecommunications expansion.

South China Sea and Beyond

Based in New Jersey, Hayduk’s leadership involved not just strategy but also the intricate management of remote supply chains, underlining the challenges within international operations.

Hayduk detailed the meticulous planning required, “Understanding every step of the planning and deployment phase is crucial. When building our Intra-Asia Cable, securing permits in the South China Sea was more challenging than anticipated, forcing us to reassess our construction strategy. The dilemma was whether to adjust our build direction or halt operations due to permit complications in contested waters.”

Elaborating further, Hayduk added, “Navigating governmental approvals was complex. Although technically in international waters, China’s territorial claims over the South China Sea meant we couldn’t assume unimpeded passage. We adopted a cautious approach, ensuring we obtained permits even in areas regarded as international waters.”

The task of deploying this subsea cable was also done during the politically sensitive period of the Beijing Olympics which added layers of complexity, and impacting construction time. Finally, the long-awaited permit approval arrived, bringing a sense of relief and accomplishment that finally allowed the construction of the cable to complete.

For other cable builds, like from the west coast of India to Europe, “We designed subsea systems to land prior to existing congested cable systems in and around the Suez Canal, and then run terrestrially through Egypt out to the Mediterranean. This approach offered a diverse alternative – a contingency in case of disruptions. Our goal was to provide a unique option from a market standpoint.”, explains Hayduk.

This example required negotiating with entities like Telecom Egypt for terrestrial builds, which required balancing practical business needs with inventive solutions. Projects around the Suez Canal demanded collaboration with local stakeholders, illustrating the intricate, often delicate geopolitical nature inherent in global telecom projects.

Hayduk explains, “This strategic decision not only highlighted the need for innovative routing solutions but also underscored the importance of robust partnerships.”

Hayduk’s insights into the pivotal Egypt project highlight the collaborative essence and strategic reliance on local partnerships that have been instrumental in Tata Communications’ growth. He notes, “For the terrestrial build, we needed to work closely with Telecom Egypt, relying on them for the cable landing station construction. This partnership underscored our dependence on local expertise and the crucial role of subcontractors in the subsea cable build process.”

By 2014, this evolution had propelled Tata Communications to a unique position as the only company with a fully-owned subsea fiber network that encircles the globe. This vast network, serving as the backbone of global connectivity, extends its reach to over 200 countries and territories. A testament to its impact, about 30% of the world’s Internet routes flow through Tata’s network.

Hayduk explains, “In this instance, we developed a consolidated subsea platform that offered significant scalability – specifically, the ability to exponentially increase bandwidth in multiples of 100Gbps units to 1Tbps and beyond, advancing towards spectrum-type fiber pair deals.”

Networks and the Future

Hayduk foresees the crucial role of advancing fiber optics and software augmentation in meeting the growing demands of technology. He emphasizes that the strategic expansion of fiber optics is key not just for increased capacity, but also for ensuring the reliability and low latency essential to support various applications. This is particularly important for applications requiring stringent response times, such as high-frequency trading and business collaboration tools, which after the pandemic, have become a critical utility.

“Immersive video, the metaverse, and augmented realities are poised to surge, demanding bandwidth to reach unprecedented heights. In this landscape, wireless technologies find their niche in providing access. However, the inherent limitations of spectrum availability underscore the perpetual need for extensive fiber optic infrastructure. As the digital realm expands with innovations like the metaverse, the hunger for increased bandwidth intensifies, necessitating further investments in fiber optics. The advent of 3D virtual experiences and the metaverse introduces a paradigm shift, demanding exponential increases in bandwidth,” Hayduk explains.

The telecom industry is on the brink of a transformation, and according to Hayduk, the future will see an unyielding demand for networks. While wireless technologies are essential, especially for access, the heart of capacity-intensive applications lies in fiber and wired solutions.

Legacy in the Telecom Space

Hayduk’s journey stands as a striking testament to his adaptability, foresight, and unwavering commitment to progress. His career, marked by significant contributions and visionary leadership, sheds light on the industry’s transformative evolution, offering valuable lessons for both seasoned leaders and aspiring newcomers navigating the rapidly changing landscape of telecommunications.

As the industry continues to evolve at a breakneck pace, Hayduk’s legacy resonates powerfully. His ability to steer the field into new frontiers, where technological innovation intersects with practical business acumen, remains exemplary.

Hayduk emphasizes, “Staying open-minded, being ready to learn, and embracing change are crucial. Adaptability and quick strategizing in the face of unforeseen challenges are key to not only good leadership but also being a great teammate. Together, we can figure anything out.”

Looking ahead, Hayduk turns our attention to emerging domains like the metaverse and the reshaping of operational landscapes by artificial intelligence. “The dynamic and challenging waters of telecommunications await the next generation of visionaries to navigate new paths and discover innovative solutions, propelling the industry into uncharted territories,” he reflects.

In the symphony of connectivity, where tomorrow’s digital possibilities resonate, John Hayduk’s influence and insights continue to serve as a guiding compass, inspiring excellence in the relentless quest to advance the world of telecommunications.

_____________

A sincere thank you to our latest Luminary, John Hayduk, for sharing his wisdom and adding his unique story that has shaped telecom today. We’ve only scratched the surface of his triumphant journey, and there’s undoubtedly more to explore. Readers, we encourage you to share your thoughts and reflections on John’s story in the comments. For suggestions on other telecom leaders to spotlight, reach out to [email protected]

More In the News

Beyond the Unexpected: How NJFX Secures Your Connectivity

The abrupt collapse of the Baltimore bridge serves as a poignant reminder of our physical infrastructure’s vulnerabilities and the cascading effects such failures can have on connectivity. In response, NJFX’s strategic foresight in crafting a resilient connectivity ecosystem emerges not just as a measure of preparedness but as a necessity.

The Future of Latin America’s Subsea Cables: A Strategic Overview

The digital infrastructure of Latin America is on the brink of a major overhaul, with subsea cables playing a pivotal role in this transformation. A panel of industry experts, including CEOs, EVPs, and senior analysts, came together to discuss the future trajectory of these essential components of the global internet backbone. Here’s a closer look at the participants and the key takeaways from their discussion.

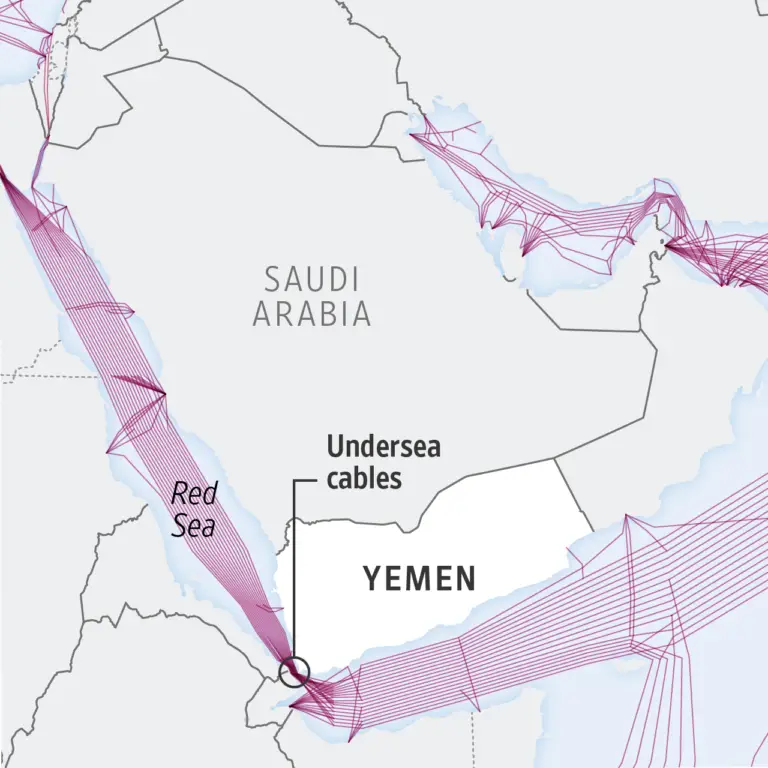

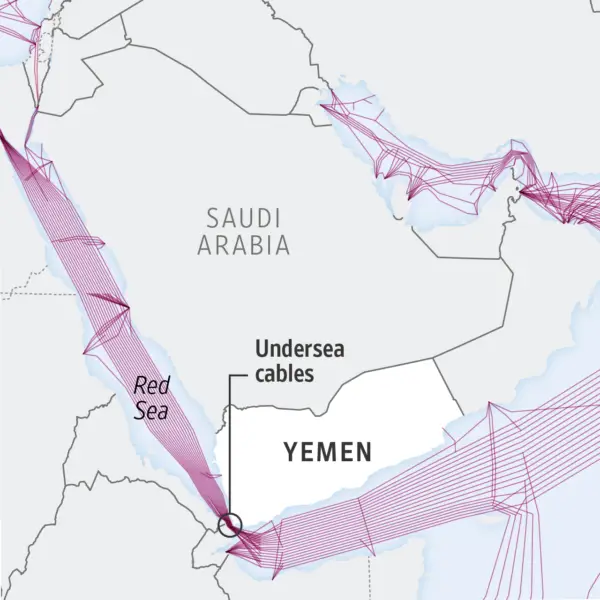

WSJ Covers Red Sea Conflict Threatening Key Subsea Cables

Red Sea conflict threatens Key Internet Cables. Maritime attacks complicate repairs on underwater cables that carry the world’s web traffic.

NJFX Completes Acquisition of Critical Transatlantic Connectivity Assets from SubCom

NJFX announces the successful acquisition of key infrastructure assets from SubCom LLC, originally developed in 2001. This acquisition comprises bore pipes and conduits situated in Manasquan and Avon, NJ. This offers purpose built underground access to the NJFX Wall CLS Campus.

Why operators and enterprises will need an AI data center strategy

Enterprises are prioritizing low-latency networks to ensure that their AI applications function at optimal efficiency and accuracy. This focus on reducing latency is about more than speed; it’s about creating a seamless, responsive experience for end-users and maintaining a competitive edge in an increasingly AI-driven market.

Critical Infrastructure Forum Educating Enterprise and Financial Markets

NJFX hosts critical infrastructure forum at their facility in Wall, New Jersey. NJFX had over 30 executives presenting to multinational banks. Learn more about the event and see picture from the day at NJFX.net.