State of AI in Telecommunications: 2023 Trends Survey Report

State of AI in Telecommunications: 2023 Trends Survey Report

Taking a Closer Look at AI in the Telecommunications Industry

From service vehicle routing and data science to voice assistants and network planning, artificial intelligence is becoming a staple in the telecoms industry. Recently, NVIDIA surveyed 400+ telecom industry professionals around the world on their views about the opportunities and challenges of implementing AI-driven practices across their company and in the industry. This report summarizes the key survey insights, as well as the investment decisions and

implementation approaches that define the state of AI in telecoms in 2023. While the responses show that there’s significant interest in AI, it’s also clear that the industry is in the early stages of its AI adoption journey and needs support to clearly define ROI.

The telecoms industry delivers critical infrastructure and services across enterprise and consumer industries, providing efficient connectivity for communication and online services around the world. Telcos (whether fixed, mobile, or cable providers) are the key players in this industry.

Together with other industry stakeholders, they spend billions of dollars annually to drive technological innovation, create new products and services, modernize their infrastructure, improve operational excellence, and deliver profitability to their shareholders. AI is increasingly an integral part of the investment roadmap, as telcos look to achieve their goals in an energy-efficient and environmentally friendly way.

In the 5G era particularly, AI will support telcos as they seek ways to deliver on expectations that 5G will bring revolutionary change across industries, while gaining a return on the significant investments they’ve made in capital, spectrum, deployment, and maintenance.

The telecoms industry is broadly positive on the need for AI in telecoms. The International Telecommunications Union (ITU)—the UN’s specialized information and communication technology (ICT) agency—promotes the AI for Good initiative. Likewise, the AI for Impact initiative by GSMA brings together a task force of 24 mobile telcos and an advisory panel of 12 UN agencies and partners to promote use of AI to achieve the UN’s Sustainable Development Goals (SDGs).

Beyond the grand industry visions and activities, this report focuses on the views of telecom industry professionals who are tasked with implementing and delivering AI in the field. It sets out to explore how committed the telecoms industry is to driving adoption of AI and how much impact AI is already having on those who have deployed it.

Survey respondents represented a mix of telcos (including mobile, fixed, and cable companies) and their hardware and software suppliers. The respondents were a good mix of different groups, like customer service, marketing, and business development, and the results include feedback from manager-level industry professionals, including senior executives.

There’s Clear Interest in and Expectations of Success From AI

In line with the industry-level expectation on the importance of AI in telecoms, the survey

shows that there’s a clear interest in AI among industry stakeholders. Of overall respondents, 95 percent said they were engaged with AI, with the figure rising to 100 percent among decision-making management respondents.

shows that there’s a clear interest in AI among industry stakeholders. Of overall respondents, 95 percent said they were engaged with AI, with the figure rising to 100 percent among decision-making management respondents.

Telcos have announced they’ve tested AI-enabled solutions for network operations, base station site planning, truck-routing optimization, and machine learning data analytics. To improve the customer experience, some are adopting recommendation engines, virtual assistants, and digital avatars. For many respondents in the survey, however, the engagement was described as at an early stage.

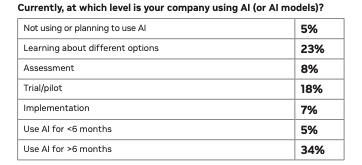

Only 34 percent of respondents reported using AI for over six months, while 23 percent of respondents said they’re still learning about the different options for AI. Eighteen percent reported being in a trial or pilot phase of an AI project.

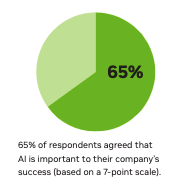

This level of engagement feeds into the expectation that AI will deliver competitive advantage and success. In the survey, based on a 7-point scale, 59 percent of respondents agreed with the statement “AI will be a source of competitive advantage for my company,” while 65 percent of respondents agreed that AI is important to their company’s success. But not everyone agrees with the industry-level view on the importance of AI in telecoms. On the same 7-point-scale question, about 12 percent of respondents disagreed that AI has a role in their company’s success.

This is understandable, as the industry is responsible for critical national infrastructure in every country, supports over 5 billion customer end points, and is expected to constantly deliver above 99 percent

reliability. Each network interface or customer touch point is potentially a drag on efficiency, creating a constant need for industry stakeholders to invest in solutions that improve operational efficiency.

reliability. Each network interface or customer touch point is potentially a drag on efficiency, creating a constant need for industry stakeholders to invest in solutions that improve operational efficiency.Likewise, 80 percent of respondents reported that their implementation of AI led to reduced annual costs in the last year, with 15 percent of respondents noting that this cost reduction is above 10 percent—again, in specific parts of their business.

introducing AI-driven solutions.

Technical challenges—whether from lack of enough skilled personnel or poor infrastructure—are also obstructing AI adoption. Of respondents, 34 percent cited an insufficient number of data scientists as the second-biggest challenge. Given that data scientists are sought after across industries, the response suggests that the telecoms industry needs to push harder to woo them.

With 33 percent of respondents also citing a lack of budget for AI projects, the results suggest that AI advocates need to work harder with decision-makers to develop a convincing case for AI adoption. Likewise, for a technology solution that relies on data, concerns about the availability, handling of, privacy, and security of data were all critical issues to be addressed, especially in the light of data privacy and data residency laws around the globe (e.g. GDPR).

In an industry with a multi-billion capex spend per annum, the level of investment in AI appears to be low. Typically, mid- to large-size telcos will spend at least a billion dollars annually on capex. Yet, 60 percent of respondents (for 2021) and 50 percent of respondents (for 2022) spent less

than $1 million on AI. On the top end, 2 percent of respondents spent over $50 million in 2021, rising to 3 percent in 2022.

adoption, it suggests that the industry’s level of investment in AI is not matching

its level of enthusiasm and engagement. Indeed, 33 percent of respondents noted

a lack of budget, and only 42 percent of respondents agreed that their current

investment is at the right level. Going forward into 2023, 47 percent of respondents reported plans to increase their AI investment, while 45 percent said they’ll be keeping it broadly the same.

Only 8 percent of respondents said they’ll be decreasing their AI spend.

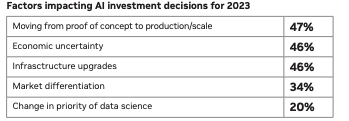

While a total of 49 percent of respondents said they were still in the learning, assessment, or trial/pilot phase of their AI investments, 47 percent of respondents said implementation plans will drive their investment decisions. Economic uncertainty and the need to prioritize spending elsewhere also drove decision-making. Some 46 percent of respondents cited concerns about

the economy; similarly, 46 percent of respondents said AI investments will be balanced against spending on scheduled infrastructure upgrades. And 34 percent of respondents noted that their market differentiation strategies are a major factor in their AI investment decisions.

provide recommendations, and manage churn. In the next 6–12 months, respondents plan to increase investment in predictive maintenance as telcos seek to leverage AI to proactively identify and fix problems in their hardware and software infrastructure. This includes

customer on-premises equipment such as mobile devices and set-top boxes.

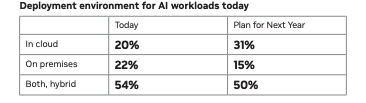

benefit from the wide variety, availability, and performance of cloud solutions

were more likely to choose a cloud environment. The lower priority of cost in this decision is insightful, as it suggests more respondents consider a more strategic approach to AI rather than a tactical, cost-driven quest for the cheapest solution in the market.

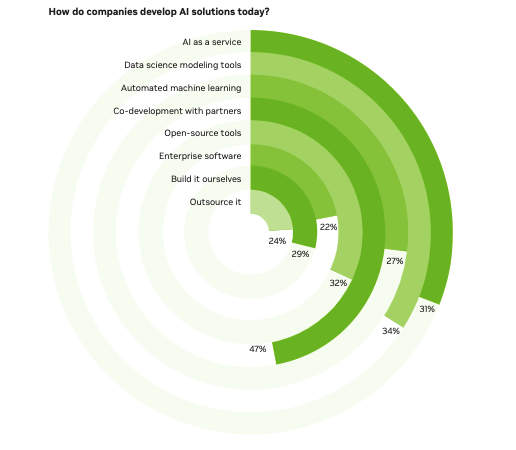

that their AI solutions are co-developed with partners, and 61 percent said their top priority when spending on AI was to “engage third-party partners to accelerate AI adoption.” Often, this need for partners is non-negotiable. A massive 83 percent of respondents said they would sometimes or always engage third-party consultants or software vendors to complete an AI project.

Partnerships also create opportunities for telcos to create new services for customers at lower investment and with the ability to scale fast. Fifty-one percent of respondents said they develop AI solutions for both internal and external users.

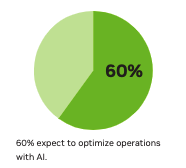

Telecom leaders are already investing significantly in AI. However, the industry as a whole lags in AI investment compared to their overall capex spend. The encouraging news is that the majority of survey respondents signaled a desire to increase their AI investments and to push for better clarity on ROI in the next year. Ultimately, it’s expected that telcos and other industry stakeholders will embrace AI to improve operational efficiency and deliver better customer experiences. In the near term, the focus appears to be on building more effective telecom infrastructure and unlocking new revenue-generating opportunities, especially together with partners.

More In the News

AI Power Prices Shaping NY NJ Data Centers

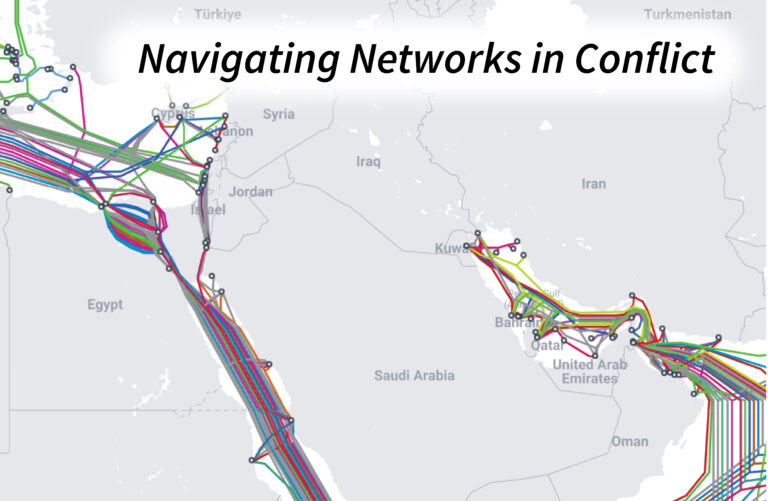

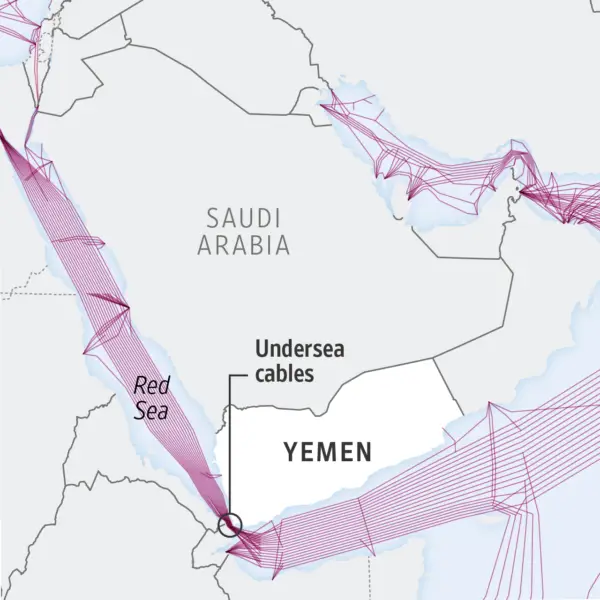

Red Sea conflict threatens Key Internet Cables. Maritime attacks complicate repairs on underwater cables that carry the world’s web traffic.

Tampnet partners with NJFX, increasing diversity for USA and European customers

Red Sea conflict threatens Key Internet Cables. Maritime attacks complicate repairs on underwater cables that carry the world’s web traffic.

WSJ Covers Red Sea Conflict Threatening Key Subsea Cables

Red Sea conflict threatens Key Internet Cables. Maritime attacks complicate repairs on underwater cables that carry the world’s web traffic.

Why operators and enterprises will need an AI data center strategy

Enterprises are prioritizing low-latency networks to ensure that their AI applications function at optimal efficiency and accuracy. This focus on reducing latency is about more than speed; it’s about creating a seamless, responsive experience for end-users and maintaining a competitive edge in an increasingly AI-driven market.

The New Wave of SMART Cables

The Science Monitoring And Reliable Telecommunications (SMART) Subsea Cables initiative seeks to revolutionize deep ocean observing by equipping transoceanic telecommunications cables with sensors to provide novel and persistent insights into the state of the ocean, at a modest incremental cost.

NJFX AND EXA INFRASTRUCTURE FORGE STRATEGIC PARTNERSHIP TO BOLSTER TRANSATLANTIC CONNECTIVITY

EXA Infrastructure, the largest dedicated digital infrastructure platform connecting Europe and North America, today has announced a strategic partnership with NJFX, a leader in carrier-neutral colocation and subsea infrastructure.

State of AI in Telecommunications: 2023 Trends Survey Report Read More »